Managing your finances can be a daunting task if you have a lot of expenses. Some people are naturally skilled at this, though others may not be as talented. Take the example of a typical man who has a wife and kids. As the primary provider, he has a desk job

Managing your finances can be a daunting task if you have a lot of expenses. Some people are naturally skilled at this, though others may not be as talented. Take the example of a typical man who has a wife and kids. As the primary provider, he has a desk job

wherein he earns about $2000 each month. He has a wife, and two kids who both go to primary school. He also has a car and a home which he is still paying for. In addition to this, he is also responsible for buying groceries for his family, as well as school supplies for his kids. He is also saving up future expenses like school tuition fees, and a college fund for both of his kids. Then, there’s also the matter of funds in case of emergencies, and savings for his retirement.

This is a very typical setup in an American household. Like most Americans, he also has a credit card which he pays off every month. However, there may be unforeseen circumstances which may prevent him from paying punctually each month, such as a sickness in the family, or expenses for car repairs. He can of course charge this to his credit card, but it may take him a while to be able to recover the money which he owes his credit card. These circumstances may also affect his ability to pay for his mortgage loan. If he has not earned enough to be able to add money to his emergency fund, then this will reflect very badly on his credit score.

What is a Credit Score?

Contents

A credit score is a number which represents how creditworthy a person is. That is, it shows the likelihood that a person will be able to pay for debts incurred in their mortgage, bank loan or credit card. Lenders like banks and credit card companies benefit from seeing consumers’ credit scores because it shows them how much of a risk will be posed by lending the money to a particular person. This score may also be referred to as the FICO (Fair, Isaac and Company) score, and it’s shown as a number. There are many types of FICO scores such as the generic/classic (ranging from 300 to 850), bankcard (ranging from 250 to 900), personal finance, mortgage (ranging from 300 to 850), installment loan, auto and the NextGen score (ranging from 150 to 950). When a person has a higher FICO score, this means that they are more creditworthy. Conversely, if their score is lower, they are less creditworthy.

A credit score is a number which represents how creditworthy a person is. That is, it shows the likelihood that a person will be able to pay for debts incurred in their mortgage, bank loan or credit card. Lenders like banks and credit card companies benefit from seeing consumers’ credit scores because it shows them how much of a risk will be posed by lending the money to a particular person. This score may also be referred to as the FICO (Fair, Isaac and Company) score, and it’s shown as a number. There are many types of FICO scores such as the generic/classic (ranging from 300 to 850), bankcard (ranging from 250 to 900), personal finance, mortgage (ranging from 300 to 850), installment loan, auto and the NextGen score (ranging from 150 to 950). When a person has a higher FICO score, this means that they are more creditworthy. Conversely, if their score is lower, they are less creditworthy.

Scott Hilton’s Credit Secret

Scott Hilton has discovered a secret for increasing your credit score practically overnight. He discovered this system during a certain period in his life when his credit score was merely 471, and he couldn’t get approved for a loan, a car, a house,

Scott Hilton has discovered a secret for increasing your credit score practically overnight. He discovered this system during a certain period in his life when his credit score was merely 471, and he couldn’t get approved for a loan, a car, a house,

or anything! During this time he just lost his job and was living off of his credit cards. And as someone who is unable to pay for his credit cards, he accumulated a huge amount of debt. In his desperation, he searched the Web for various “tricks” for increasing his credit score, and he even hired a “credit repair” company!

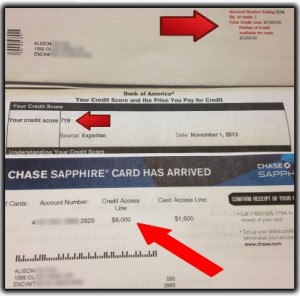

When none of these methods worked in improving his score, he looked to the law to see if there were any loopholes he could make use of. And within those pages of legal clauses, he found his ticket to a better credit score. Seeing as there is no text in the law saying that making use of this loophole was illegal, he put his newfound discovery to the test. At the time, he has 12 negative accounts on his credit report, and he used his little trick on every single one of them. Weeks later, he received letters in the mail telling him that these items were already deleted, as if they never happened! In fact, he even received $1000 from American Express, with a letter of apology for his troubles.

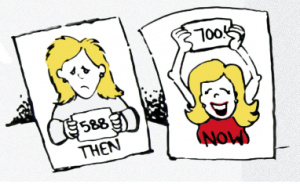

Eventually, his credit score became perfect and 100 percent successful. He even tried out the trick with his girlfriend’s credit score, and after a couple of weeks it went from 588 to 700! And she got approved for a new credit card. With this little trick, there will be no more collection agencies pestering you to pay your debts, no more embarrassing letters in the mail, and no more fear of applying for a loan, a credit card, a car or a house! With Scott Hilton’s Credit Secret, you can be able to start off with a clean slate!

What We Like About Credit Secret

- Imagine starting off clean and being able to take out a loan again once your credit score has been improved. It will be like you will now be viewed as a creditworthy consumer who knows how to pay his or her own credit card bills, mortgage payments, and loan payments.

- There’s no more need for you to borrow money from loan sharks who may pile on impossible interest rates. With Scott Hilton’s Credit Score, you can take out a loan once again, and hopefully this time, you will be able to clear your credit line without the need for a loophole in the system.

- This method is 100% legal, and will be able to help you shake off collection agencies.

What We Don’t Like About Credit Secret

- Credit Secret is not a miracle cure for making big bucks off a legal loophole. Hopefully when you have fixed your credit score, you will no longer go back to your old financial habits. We hope that you won’t just go into a

cycle of taking out a loan, clearing your credit score, and taking out another loan as this would be an abuse of the system.

cycle of taking out a loan, clearing your credit score, and taking out another loan as this would be an abuse of the system.

Our Final Verdict

There’s the easy way of getting a better score (such as paying off your debts) and then there’s the easy way to getting a bank loan approved. Scott Hilton’s Credit Secret can help increase your credit score so you can take out a loan, and hopefully use this to repair past financial mistakes. Not only is it incredibly effective, but it may just be the shining light you need in order to learn from your past mistakes.